Swanky net worth refers to the financial assets and wealth accumulated by individuals or entities that are considered to be fashionable, sophisticated, and luxurious.

Understanding swanky net worth can provide valuable insights into consumer spending patterns, investment trends, and the overall health of the luxury goods market. It can also serve as an indicator of economic growth and stability.

In this article, we will explore the concept of swanky net worth in greater detail, examining its importance, benefits, and historical context. We will also discuss the main factors that contribute to swanky net worth and how it is measured and tracked.

Swanky Net Worth

Swanky net worth is a term used to describe the financial assets and wealth accumulated by individuals or entities that are considered to be fashionable, sophisticated, and luxurious. It can be a useful indicator of economic growth and stability, and can provide insights into consumer spending patterns and investment trends.

- Assets: Swanky net worth includes all financial assets, such as stocks, bonds, real estate, and cash.

- Debt: Swanky net worth is calculated by subtracting all debts from total assets.

- Investments: Swanky net worth can be increased through investments in stocks, bonds, and other financial instruments.

- Income: Swanky net worth is also affected by income, as higher incomes can lead to greater wealth accumulation.

- Spending: Swanky net worth can be decreased by spending, as excessive spending can erode wealth.

- Lifestyle: Swanky net worth can be influenced by lifestyle choices, as luxurious lifestyles can lead to higher spending and lower net worth.

- Age: Swanky net worth tends to increase with age, as individuals have more time to accumulate wealth.

- Location: Swanky net worth can vary depending on location, as the cost of living and investment opportunities can differ significantly from one place to another.

- Economic conditions: Swanky net worth can be affected by economic conditions, as recessions and depressions can lead to losses in wealth.

In conclusion, swanky net worth is a complex and multifaceted concept that is influenced by a variety of factors. It is important to consider all of these factors when assessing swanky net worth, as they can provide valuable insights into the financial health of individuals and entities.

Assets

Assets are a crucial component of swanky net worth, as they represent the financial resources that can be used to fund a luxurious lifestyle. Stocks, bonds, real estate, and cash are all considered to be assets, and their value can fluctuate over time. When the value of these assets increases, so too does swanky net worth. Conversely, when the value of these assets decreases, swanky net worth will also decline.

For example, if an individual has a portfolio of stocks that increases in value by 10%, their swanky net worth will also increase by 10%. Similarly, if an individual purchases a piece of real estate that appreciates in value, their swanky net worth will also increase. Conversely, if the stock market crashes and the value of an individual's portfolio decreases by 20%, their swanky net worth will also decrease by 20%.

It is important to note that assets are not the only factor that contributes to swanky net worth. Debt, income, spending, and lifestyle choices can also play a role. However, assets are a key component of swanky net worth, and they can provide valuable insights into the financial health of individuals and entities.

Understanding the connection between assets and swanky net worth can be useful for a variety of purposes. For example, it can help individuals to make informed investment decisions, plan for retirement, and manage their wealth more effectively. It can also help businesses to assess the financial health of their customers and partners.

Debt

Debt is a crucial component of swanky net worth, as it represents the financial obligations that must be repaid. Debt can come in many forms, such as mortgages, car loans, credit card debt, and personal loans. When an individual or entity has a high level of debt, it can significantly reduce their swanky net worth.

For example, if an individual has $1 million in assets and $500,000 in debt, their swanky net worth would be $500,000. This is because their total assets are reduced by the amount of their debt. Conversely, if an individual has $1 million in assets and no debt, their swanky net worth would be $1 million.

It is important to note that debt is not always a bad thing. In some cases, debt can be used to finance investments that can generate a return greater than the cost of the debt. However, it is important to manage debt carefully, as excessive debt can lead to financial problems.

Understanding the connection between debt and swanky net worth is important for a variety of reasons. For example, it can help individuals to make informed borrowing decisions, manage their debt more effectively, and plan for the future. It can also help businesses to assess the financial health of their customers and partners.

Investments

Investments are a crucial component of swanky net worth, as they can provide a way to generate income and grow wealth over time. Stocks, bonds, and other financial instruments can all be used to create a diversified portfolio that can help to reduce risk and maximize returns.

For example, if an individual invests $100,000 in a stock index fund that returns 7% per year, their investment will be worth $107,000 after one year. If they continue to invest $100,000 each year and earn a 7% return, their investment will be worth over $1 million after 10 years. This is a powerful example of how investments can be used to grow swanky net worth over time.

It is important to note that investments are not without risk. The value of stocks, bonds, and other financial instruments can fluctuate over time, and there is always the potential to lose money. However, by diversifying their portfolio and investing for the long term, individuals can reduce their risk and increase their chances of success.

Understanding the connection between investments and swanky net worth is important for a variety of reasons. For example, it can help individuals to make informed investment decisions, plan for retirement, and manage their wealth more effectively. It can also help businesses to assess the financial health of their customers and partners.

Income

Income is a crucial component of swanky net worth, as it provides the financial resources that can be used to fund a luxurious lifestyle and invest for the future. Individuals and entities with higher incomes are able to save and invest more money, which can lead to greater wealth accumulation over time.

- Earned Income: Earned income is the money that individuals receive from their jobs, salaries, and wages. Earned income is the most common type of income, and it is a major contributor to swanky net worth.

- Investment Income: Investment income is the money that individuals receive from their investments, such as stocks, bonds, and real estate. Investment income can be a significant contributor to swanky net worth, especially for individuals who have a large investment portfolio.

- Passive Income: Passive income is the money that individuals receive from sources that do not require active participation. Passive income can include rental income, royalties, and dividends. Passive income can be a valuable contributor to swanky net worth, as it can provide a steady stream of income without the need for active work.

- Other Income: Other income includes any other sources of income that do not fall into the categories of earned income, investment income, or passive income. Other income can include inheritances, gifts, and lottery winnings. Other income can be a significant contributor to swanky net worth, especially for individuals who have received a large inheritance or lottery winnings.

In conclusion, income is a crucial component of swanky net worth, and individuals with higher incomes are able to save and invest more money, which can lead to greater wealth accumulation over time. Understanding the connection between income and swanky net worth is important for a variety of reasons. For example, it can help individuals to make informed career decisions, plan for retirement, and manage their wealth more effectively. It can also help businesses to assess the financial health of their customers and partners.

Spending

Spending is a crucial component of swanky net worth, as it can significantly impact the accumulation and preservation of wealth. Excessive spending can quickly erode swanky net worth, while mindful spending can help to maintain and grow wealth over time.

- Discretionary Spending: Discretionary spending is the money that individuals and entities spend on non-essential items, such as entertainment, dining out, and travel. While discretionary spending can be enjoyable, it is important to keep it within reasonable limits. Excessive discretionary spending can quickly lead to debt and financial problems.

- Non-Discretionary Spending: Non-discretionary spending is the money that individuals and entities spend on essential items, such as housing, food, and transportation. Non-discretionary spending is typically less flexible than discretionary spending, but it can still be managed to some extent. For example, individuals can save money on housing by choosing to live in a smaller home or in a less expensive neighborhood. They can also save money on food by cooking at home more often and by buying generic brands.

- Impulse Spending: Impulse spending is the money that individuals and entities spend on items that they do not need or want. Impulse spending can be a major drain on swanky net worth. Individuals can reduce impulse spending by avoiding shopping when they are bored or stressed, and by making a list of what they need before they go shopping.

- Emotional Spending: Emotional spending is the money that individuals and entities spend to make themselves feel better. Emotional spending can be a problem for individuals who are struggling with stress, anxiety, or depression. Individuals can reduce emotional spending by identifying the triggers that lead them to spend money and by developing healthier coping mechanisms.

In conclusion, spending is a crucial component of swanky net worth, and it is important to manage spending carefully in order to maintain and grow wealth over time. By avoiding excessive spending, individuals and entities can protect their swanky net worth and achieve their financial goals.

Lifestyle

Understanding the connection between lifestyle and swanky net worth is important for individuals and entities who are seeking to maintain and grow their wealth. Lifestyle choices can have a significant impact on spending habits and financial well-being.

- Spending habits: Luxurious lifestyles often involve high levels of spending on discretionary items, such as entertainment, dining out, and travel. This type of spending can quickly erode swanky net worth if it is not managed carefully. Individuals and entities who are serious about building and maintaining swanky net worth should focus on developing mindful spending habits and avoiding excessive discretionary spending.

- Investment decisions: Lifestyle choices can also impact investment decisions. Individuals and entities who are focused on building swanky net worth may choose to invest in assets that generate passive income, such as rental properties or dividend-paying stocks. This type of income can help to offset the costs of a luxurious lifestyle and contribute to long-term wealth accumulation.

- Debt management: Lifestyle choices can also affect debt management. Individuals and entities who are living beyond their means may be more likely to accumulate debt, which can have a negative impact on swanky net worth. It is important to manage debt carefully and avoid taking on more debt than can be comfortably repaid.

- Financial planning: Lifestyle choices should be considered in the context of overall financial planning. Individuals and entities who are serious about building and maintaining swanky net worth should develop a comprehensive financial plan that takes into account their lifestyle goals and financial objectives.

In conclusion, lifestyle choices can have a significant impact on swanky net worth. Individuals and entities who are seeking to maintain and grow their wealth should focus on developing mindful spending habits, making sound investment decisions, managing debt carefully, and developing a comprehensive financial plan.

Age

The connection between age and swanky net worth is a well-established one. As individuals progress through their careers and lives, they typically have more time to accumulate wealth. This is due to a number of factors, including increased earning power, investment experience, and a longer time horizon for saving and investing.

For example, a recent study by the Pew Research Center found that the median net worth of households headed by someone aged 65 or older was $208,000, compared to just $68,000 for households headed by someone under the age of 35. This gap is largely due to the fact that older households have had more time to accumulate wealth through savings, investments, and home equity.

Understanding the connection between age and swanky net worth is important for a number of reasons. First, it can help individuals to set realistic financial goals for themselves. For example, a young person who is just starting out in their career may not be able to expect to have the same net worth as someone who has been working for 20 or 30 years. Second, it can help individuals to make informed investment decisions. For example, a younger person with a longer time horizon for investing may be able to afford to take on more risk in their investment portfolio than an older person who is closer to retirement.

In conclusion, the connection between age and swanky net worth is a complex one that is influenced by a number of factors. However, it is generally true that individuals have more time to accumulate wealth as they get older. This is an important consideration for individuals who are planning for their financial future.

Location

The location of an individual or entity can have a significant impact on their swanky net worth. This is due to a number of factors, including the cost of living, investment opportunities, and tax rates.

For example, individuals and entities living in areas with a high cost of living may have a lower swanky net worth than those living in areas with a lower cost of living. This is because they have to spend more of their income on basic necessities, such as housing, food, and transportation. As a result, they have less money available to save and invest.

In addition, the location of an individual or entity can also affect their investment opportunities. For example, individuals and entities living in areas with a strong economy and a vibrant investment market may have access to a wider range of investment opportunities than those living in areas with a weaker economy and a less developed investment market. This can lead to significant differences in swanky net worth over time.

Finally, the location of an individual or entity can also affect their tax rates. For example, individuals and entities living in areas with high tax rates may have a lower swanky net worth than those living in areas with lower tax rates. This is because they have to pay more of their income in taxes, leaving them with less money to save and invest.

In conclusion, the location of an individual or entity can have a significant impact on their swanky net worth. Individuals and entities who are considering relocating should carefully consider the cost of living, investment opportunities, and tax rates in their new location.

Economic conditions

Swanky net worth is closely tied to economic conditions, and fluctuations in the economy can have a significant impact on the wealth of individuals and entities. Economic downturns, such as recessions and depressions, can lead to job losses, reduced income, and decreased asset values, all of which can negatively impact swanky net worth.

- Job losses: During economic downturns, businesses may be forced to lay off employees in order to reduce costs. This can lead to a loss of income for individuals and families, which can make it difficult to maintain a swanky lifestyle and invest for the future.

- Reduced income: Even if individuals are able to keep their jobs during an economic downturn, they may still experience a reduction in income. This is because businesses may be forced to reduce wages or salaries in order to stay afloat.

- Decreased asset values: Economic downturns can also lead to a decrease in asset values, such as stocks, bonds, and real estate. This is because investors may become more risk-averse and sell off their assets, which can drive down prices.

In conclusion, economic conditions can have a significant impact on swanky net worth. Individuals and entities who are heavily reliant on their income or investments may be particularly vulnerable to losses in wealth during economic downturns. It is important to be aware of this connection and to take steps to protect your financial well-being during challenging economic times.

FAQs

This section addresses frequently asked questions regarding "swanky net worth" to provide further clarity and insights.

Question 1: What exactly is considered "swanky net worth"?

Swanky net worth refers to the total financial assets and wealth accumulated by individuals or entities that exhibit a fashionable, sophisticated, and luxurious lifestyle.

Question 2: How can I calculate my swanky net worth?

To calculate your swanky net worth, simply add up all your financial assets, including cash, stocks, bonds, real estate, and other investments. Then, subtract any outstanding debts or liabilities you may have. The resulting figure represents your swanky net worth.

Question 3: What are the key factors that influence swanky net worth?

Swanky net worth is influenced by a combination of factors, including income, spending habits, investment decisions, age, location, and overall economic conditions.

Question 4: How can I increase my swanky net worth?

To increase your swanky net worth, focus on increasing your income, managing your spending wisely, and making sound investment decisions. Additionally, consider factors such as your age, location, and the prevailing economic conditions.

Question 5: What are the potential risks associated with swanky net worth?

While a swanky net worth can provide financial freedom and the ability to enjoy a luxurious lifestyle, it also comes with potential risks. Economic downturns, poor investment decisions, and excessive spending can all lead to a decline in swanky net worth.

Question 6: How can I protect my swanky net worth?

To protect your swanky net worth, consider diversifying your investments, managing your debt effectively, and planning for unexpected financial events. Additionally, stay informed about economic trends and make adjustments to your financial strategy as needed.

Understanding these FAQs can help you navigate the complexities of swanky net worth and make informed decisions to achieve your financial goals.

For further insights and guidance, explore the following sections of this article.

Tips for Building and Maintaining Swanky Net Worth

Building and maintaining a swanky net worth requires careful planning, informed decision-making, and strategic financial management. Here are five essential tips to help you achieve your financial goals:

Tip 1: Increase Your Income

Growing your income is crucial for accumulating wealth. Explore opportunities for career advancement, invest in education and skills development, and consider starting a side hustle or business to supplement your primary income.

Tip 2: Manage Your Spending Wisely

Track your expenses meticulously and identify areas where you can reduce unnecessary spending. Create a budget that aligns with your financial goals and stick to it as much as possible. Prioritize essential expenses and consider negotiating lower rates on bills and services.

Tip 3: Make Sound Investment Decisions

Educate yourself about different investment options and seek professional advice if needed. Diversify your portfolio to spread risk and consider a mix of stocks, bonds, real estate, and alternative investments. Regularly review your investments and make adjustments as market conditions change.

Tip 4: Leverage Your Age and Location

As you progress in your career and life, you will have more time to accumulate wealth and benefit from compound interest. Consider your age and location when making investment and retirement planning decisions. Seek opportunities in areas with strong economic growth and favorable tax rates.

Tip 5: Plan for Economic Downturns

Economic downturns are inevitable, so it is crucial to prepare for them. Maintain an emergency fund to cover unexpected expenses, diversify your investments, and consider hedging strategies to minimize potential losses. Regularly review your financial plan and make adjustments as needed to safeguard your swanky net worth.

By following these tips, you can build and maintain a swanky net worth that supports your desired lifestyle and financial aspirations. Remember to stay informed about economic trends, seek professional advice when necessary, and remain disciplined in your financial management practices.

Conclusion

In conclusion, "swanky net worth" encompasses the financial assets and wealth of individuals or entities characterized by sophisticated and luxurious lifestyles. By understanding its components and dynamics, individuals can make informed decisions to build and maintain their swanky net worth.

This article has explored the key factors that influence swanky net worth, including income, spending habits, investment strategies, age, location, and economic conditions. It has also provided practical tips to help individuals achieve their financial goals and protect their wealth during economic downturns.

Swanky net worth is not merely a measure of financial success but also a reflection of one's lifestyle choices and values. It is important to strike a balance between enjoying the finer things in life and making wise financial decisions that ensure long-term financial security and well-being.

Unveiling Jeff Francoeur's Net Worth: Discoveries And Insights

Unveiling Cooper Alan's Height: Unlocking Discoveries And Insights

Unveiling The Secrets: Discover The Untold Wealth Of Sunny Sandler

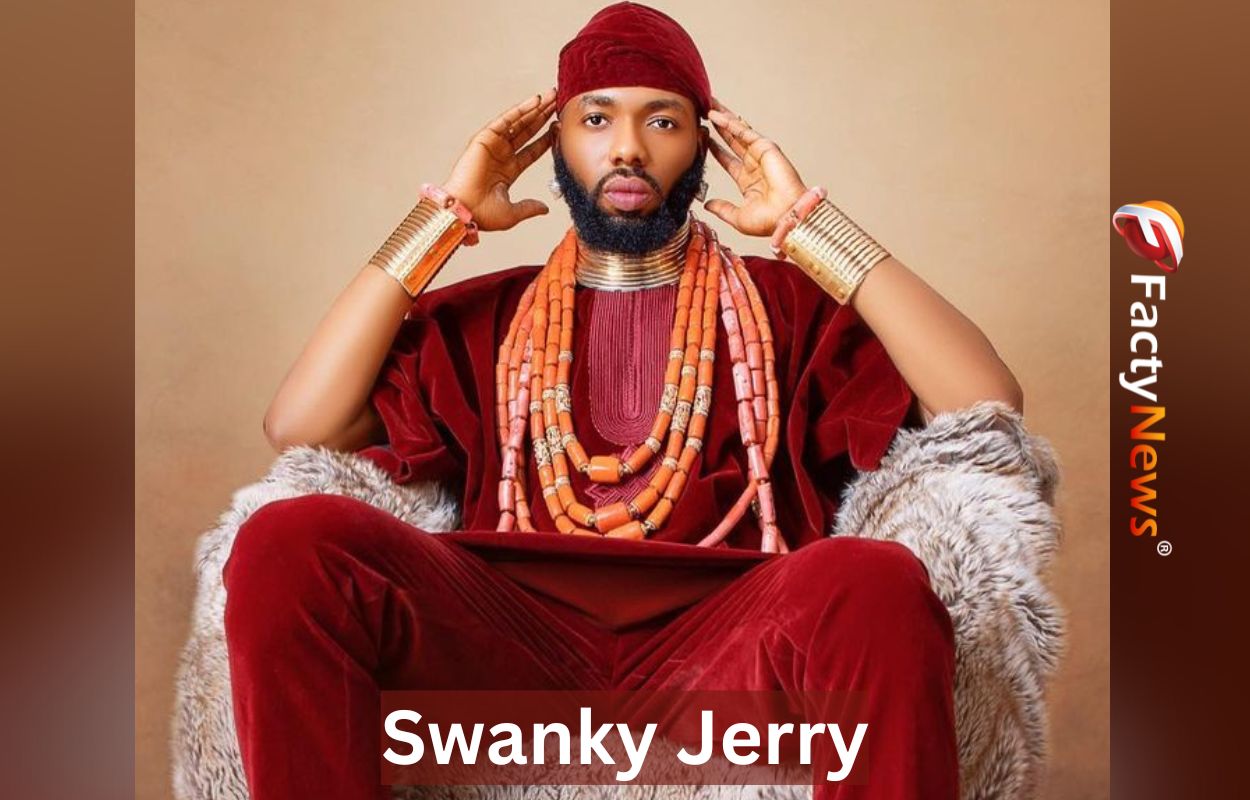

All About Swanky Jerry Young, Famous Model Swanky Jerry Partner, Bio

Swanky Jerry Age, Wife, Parents, Biography, Wiki, Height, Net worth & More

ncG1vNJzZminlpuus3rSbGWuq12ssrTAjGtlmqWRr7yvrdasZZynnWTAuK3NpLBmppWperi70a2fZ6Ckork%3D